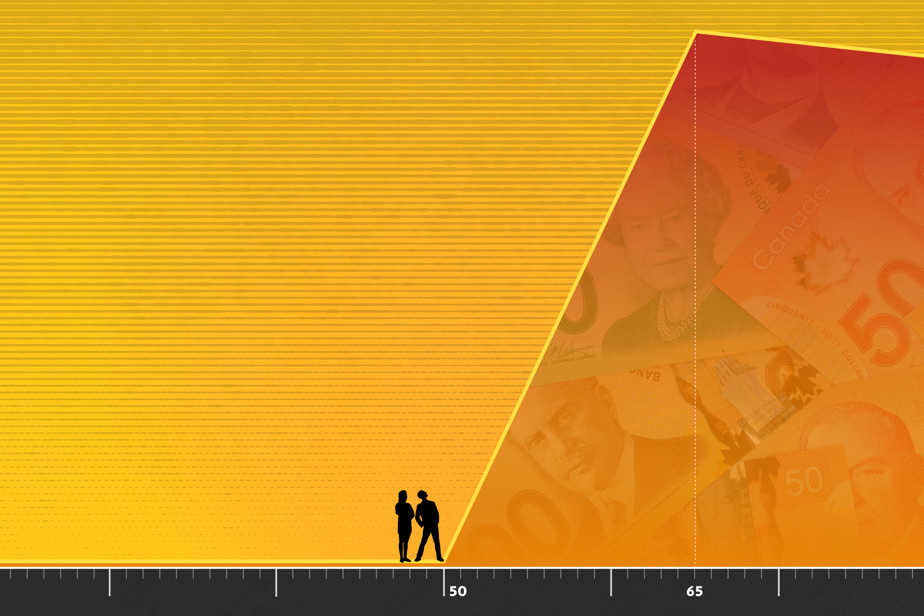

You’re entering your early 50s with no savings and hoping to retire at 65. Is this disaster? Can you catch up? If so, then how do you build retirement savings at high speed?

“Without personal retirement savings or without an employer pension plan, and relying only on government pensions [provincial RRQ and federal PSV] for retirement income, it is a lifestyle close to the poverty line – approximately $28,000 per year – to which you could be subject once you retire after age 65,” immediately warns Charles-Antoine Gohier, head of the financial planning practice at National Bank Wealth Management. He is also a member of the board of directors of the Financial Planning Institute.

However, it is still possible to replenish this lack of retirement savings during the fifteen years of employment income before retirement.

“We should not be discouraged, even if this effort to catch up on retirement savings risks having a significant impact on budgetary priorities during the years before retirement,” adds Mr. Gohier. How significant?

“It all depends on the desired or predictable lifestyle in retirement. For example, for a recent fifty-year-old who is about fifteen years from retirement at age 65, the contributions required to build up retirement savings capital can vary by approximately $1,500 per month, for a typical lifestyle from $40,000 per year, up to an amount of at least $6,000 per month to finance a lifestyle of $80,000 per year. »

In order to see things more clearly, La Presse had Charles-Antoine Gohier and his colleagues calculate the amounts of financial assets in retirement savings that would be necessary at age 65 to support different standards of living in retirement.

Also, these calculations make it possible to estimate the monthly retirement savings contributions that would be necessary during the 15 years before retirement in order to accumulate sufficient capital for the lifestyle envisaged after age 65.

These calculations were made on an individual basis with these basic characteristics:

– a person aged 50 in 2024 who plans to retire at 65;

– a person eligible at age 65 for public pensions at the maximum amounts foreseeable in 15 years (provincial RRQ and federal PSV, approx. $28,000 per year);

– a person without an employer pension plan, and without assets that can be converted into cash upon retirement (real estate, investments, etc.)

That said, how can we replenish the lack of retirement savings over the next 15 years before retirement at 65?

In fact, recalls Charles-Antoine Gohier, the relevant answers to this question depend on various elements of the lifestyle planned for retirement, and which can vary greatly from one person to another.

“He should also prepare to have to postpone his retirement after age 65 in order to benefit from a few additional years of employment income, in addition to increasing the amounts of public pensions [provincial RRQ and federal PSV] for each year of deferral of application after age 65. »

In the case of the provincial QPP, for example, each year of deferral of application increases by a little more than 8% the amount of future monthly pensions which will be paid until the end of life.

“It is difficult to obtain such a return in supplementing your retirement income with financial assets held in an RRSP [registered retirement savings plan] or a TFSA [tax-free savings account],” points out Christophe Faucher-Courchesne, who is a financial planning analyst in the group led by Charles-Antoine Gohier at National Bank Financial.

But before arriving at such a postponement of retirement, reassures Mr. Gohier, there are basic rules in financial planning which can serve as a general backdrop for a fifty-year-old worried about his future retirement income.

First of all, “we must prioritize the settlement of all debts, starting with those with the highest interest rates” such as balances on credit cards, car loans and personal consumer loans.

Secondly, a fifty-year-old lacking savings for his retirement plan in about fifteen years should seek to maximize his annual contributions to an RRSP while his taxable income from employment and other sources approaches its peak in career.

“This is the best way to optimize RRSP returns in the long term: contribute to the maximum of your tax allowance and your savings capacity in order to optimize tax credits during years of work with taxable income higher, summarizes Charles-Antoine Gohier.

“And once you retire, you can spread out your RRSP withdrawals – which are taxable – based on your other income so as to minimize your tax rate on your entire income. »

As for the TFSA, Mr. Gohier believes that it is also a good way for a fifty-year-old to replenish his or her retirement savings, which are still deficient about fifteen years before retirement.

But as the tax advantage of the TFSA comes down to the tax exemption on the return and appreciation of the assets held in the TFSA, Mr. Gohier considers that it is a second savings priority after having optimized RRSP contributions.

“After the income tax exemption, the TFSA has the particular advantage of being more flexible than the RRSP when the time comes to make disbursements as additional income in retirement, and which does not will not be counted as taxable income like RRSP withdrawals would be,” summarizes Charles-Antoine Gohier.

“It must therefore be considered individually depending on the desired lifestyle and overall anticipated retirement income. »